Teaching financial literacy usually isn’t something we think about when we’re teaching algebra, but they go together so well.

You know that moment when a student throws their hands up in frustration and asks, “Why do I even need to learn this stuff?”

It’s a classic algebra teacher experience, right?

And while we could answer with all the textbook reasons, there’s one real-world connection that always grabs their attention: money.

Algebra and financial literacy go hand in hand.

Whether it’s setting up a budget, calculating interest, or figuring out how long it’ll take to save for that must-have item, algebra is everywhere in personal finance.

The skills we teach—like solving for x, analyzing relationships, and predicting outcomes—are exactly what students need to make smart financial decisions as they grow.

In this post, we’re going to break down how algebra can help students become more financially literate.

We’ll look at key concepts like equations, ratios, and functions, and how they tie into real-world money management.

Plus, we’ll share ideas for weaving financial literacy into your algebra lessons so students see the bigger picture: math isn’t just for the classroom—it’s for life.

In a rush?

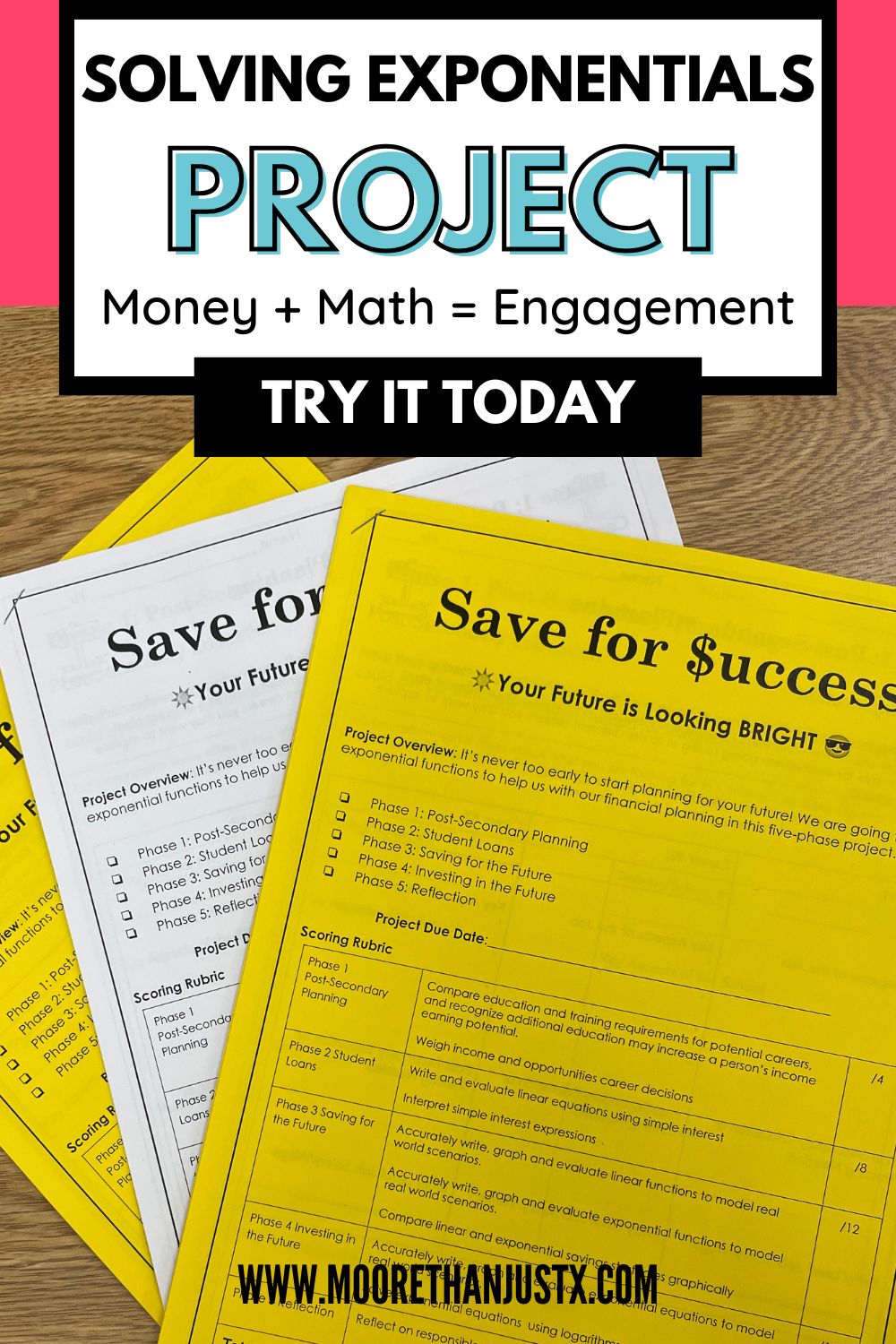

Then you should definitely check out my Save for Success project!

➡️ Click here to learn more about this linear exponential and logarithm project

About Kristen and Moore Than X

I’m a high school math teacher who’s passionate about project-based learning, and making math relevant for students.

You can learn more about me and Moore Than X here.

View this post on Instagram

A post shared by Kristen | The Modern Math Teacher Podcast (@moorethanjustx)

The Overlap Between Algebra and Financial Literacy

Algebra isn’t just about numbers and letters floating around on a worksheet—it’s about understanding how things relate to each other and solving problems.

And if you think about it, that’s exactly what financial literacy is, too.

Financial literacy means being able to manage money wisely, make smart decisions, and plan for the future.

Algebra gives students the tools to do just that by teaching them how to analyze relationships, think critically, and solve for the unknown.

For example, setting up and sticking to a budget is essentially solving an equation: if you know your income and expenses, you can figure out what’s left for savings.

Or take interest rates—understanding how they affect the cost of a loan over time is just applying math to real life.

The connections are everywhere.

When students see how algebra can help them handle money in the real world—whether it’s calculating discounts, understanding taxes, or planning for a big purchase—it makes those abstract equations feel way more practical.

Suddenly, they’re not just solving for x; they’re solving for their future. And that’s a lesson that sticks.

Key Algebraic Concepts That Support Financial Literacy

When it comes to financial literacy, algebra is like the ultimate toolkit. It’s packed with concepts that help students understand how money works and how to make it work for them.

Here are some of the heavy hitters:

Equations and Variables

At its core, budgeting is just one big algebra problem. Students can use equations to figure out how much they need to save each month to reach a goal—whether it’s for a new phone or college tuition.

For example, if they want to save $500 in 5 months, they can solve for x in 5x=5005x = 5005x=500. Spoiler alert: it’s $100 a month.

Ratios and Proportions

Ever had to decide between two credit cards with different interest rates? That’s ratios in action.

Teaching students how to compare proportions—like interest rates or savings account returns—helps them make better financial choices.

Bonus points if you throw in a real-world example, like splitting a restaurant bill with friends.

Linear Relationships

Understanding fixed versus variable expenses is a life skill everyone needs.

Students can use linear equations to map out things like monthly subscriptions (fixed) versus fluctuating grocery costs (variable).

Seeing it on a graph makes the concept even clearer.

Functions and Graphs

Speaking of graphs, this is where algebra gets really fun. Students can use functions to track savings growth over time or predict how long it will take to pay off a loan.

Visualizing their money on a graph not only makes it real but also shows them the power of making smart financial decisions.

By connecting these algebraic concepts to everyday money scenarios, students don’t just learn math—they learn life skills. It’s not just about solving problems in the classroom; it’s about solving problems in the real world.

And isn’t that what we’re really here to teach?

I love using algebra to teach financial literacy to students.

➡️ Click here to learn more about my Save for Success project if you want to do the same!

Teaching Financial Literacy Through Algebra Lessons

Let’s face it: students learn best when they can see how a lesson applies to their everyday lives.

And when it comes to algebra and financial literacy, the possibilities for real-world connections are endless.

Here are some practical ways to bring these two topics together in your classroom:

Budgeting with Equations

Give students a fictional budget to manage, complete with income, expenses, and savings goals.

Have them write equations to figure out what they can save each month or how long it will take to afford a big-ticket item.

For example, if they earn $200 a month and want to save $600, how many months will it take? Bonus: This activity doubles as a crash course in adulting.

Loan Repayments and Functions

Use linear and exponential functions to teach students about loans.

They can calculate how long it takes to pay off a loan based on different monthly payments or compare the total cost of a loan with varying interest rates.

Want to make it even more engaging? Tie it to something they care about, like buying a car or financing a new gaming console.

Discounts, Taxes, and Tips

Students love a good deal, so why not turn algebra into a shopping adventure?

Teach them how to calculate discounts, sales tax, and tips using percentages and equations.

For example, if an item is 25% off and costs $40 after the discount, what was the original price? This is a skill they’ll use for the rest of their lives.

Group Projects: Planning for the Future

Divide students into groups and give them a scenario to solve, like planning a dream vacation or saving for college.

They’ll use algebra to create a financial plan, including income, expenses, and savings.

Not only does this make math more collaborative, but it also shows them the power of planning and problem-solving.

By weaving financial literacy into your algebra lessons, you’re giving students more than just math skills—you’re giving them the confidence to take control of their future.

When they realize how useful these lessons are in real life, they might just stop asking, “When am I ever going to use this?” (Well, at least for a little while.)

Projects are always a great way to get students actively involved in their learning.

➡️ Check out the Save for Success Project!

Teaching financial literacy through algebra is a great way to have them apply what they’re learning right away.

Resources for Teaching Algebra and Financial Literacy

Integrating financial literacy into your algebra lessons doesn’t have to mean reinventing the wheel.

There are plenty of resources out there to help you bring these concepts to life in a way that’s practical, engaging, and fun for your students.

Here are some ideas to get you started:

1. Interactive Tools and Apps

- Budgeting Apps

Use tools like Mint or EveryDollar to show students how to track income and expenses in real time. You can even create mock budgets for practice. - Loan Calculators

Online calculators are a great way to help students visualize how interest works and how monthly payments affect loan balances over time. - Financial Literacy Games

Check out free online games that let students simulate managing money, like “Payback” by Next Gen Personal Finance.

2. Hands-On Activities

- Algebra-Based Worksheets

Create or download worksheets that combine solving equations with real-world money scenarios, like budgeting or calculating discounts. - Project-Based Learning

Assign projects where students plan a dream vacation, save for a big purchase, or map out college expenses. The more relatable, the better! - Classroom Challenges

Turn financial problems into friendly competitions. For example, challenge students to create the most cost-effective monthly budget or calculate savings goals under different conditions.

3. Ready-Made Resources

- TPT Financial Literacy Activities

TeachersPayTeachers has a ton of resources created by educators who’ve already done the heavy lifting. Look for activities that blend algebra with real-life money skills. I have loads of resources in my TpT store for you to shop! - Curriculum Guides

Organizations like Next Gen Personal Finance or Junior Achievement offer free lesson plans and activities that integrate math and financial literacy.

4. Real-World Examples

- News and Trends

Use current events to spark conversations about finances. For example, discuss how interest rates affect car loans or how inflation impacts grocery bills. - Guest Speakers

Invite a financial advisor or banker to talk to your class about managing money and how math plays a role in their work.

5. Online Simulations

- Stock Market Simulators

Let students practice buying and selling stocks using mock money. They’ll learn about investing while applying algebraic thinking to track their “portfolio.” - Savings Growth Models

Use spreadsheets or free software to help students experiment with savings and interest. They can see how small, consistent contributions grow over time.

➡️ Your students will love the Save for Success Project! Click here to learn more!

Algebra Can Help Your Students Become Financially Literate

When students ask, “Why do we need to learn this?” you now have the perfect answer now.

Algebra isn’t just about solving equations—it’s about solving real-life problems.

By teaching them how to connect math to money, you’re equipping them with skills that will serve them far beyond the classroom.

Financial literacy is one of the most important lessons we can teach our students.

Algebra gives them the tools to think critically, analyze relationships, and make informed decisions about their finances—whether it’s budgeting, understanding loans, or planning for the future.

It’s not just about knowing the numbers; it’s about feeling confident and prepared to manage whatever life throws their way.

When you bring financial literacy into your algebra lessons, you’re helping students see the bigger picture. They’re learning how to build a solid foundation for their future, and they’ll carry with them for the rest of their lives.